The Average Cost of Car Insurance

How much is car insurance for the average American? What is the average car insurance rate by age and gender?

We pulled data from several top sources for car insurance data to get the answers. Some of the results were just as we expected – for example, teens pay too much for car insurance.

There were also plenty of surprises, such as a low credit score being almost as bad for your insurance rate as driving under the influence (DUI).

Keep reading for all the latest information on the average cost of auto insurance.

key findings

The average cost of car insurance for a one-year policy with full coverage is $1,569.

Teens have the most expensive car insurance rates by a wide margin, with policies more than double those of any other age group.

Car insurance rates are among the lowest for drivers in their 50s.

Rates are higher for young male drivers than for younger female drivers, but there is minimal difference by gender for drivers age 25 and older.

Hybrids are the most expensive type of car to insure, followed by sedans.

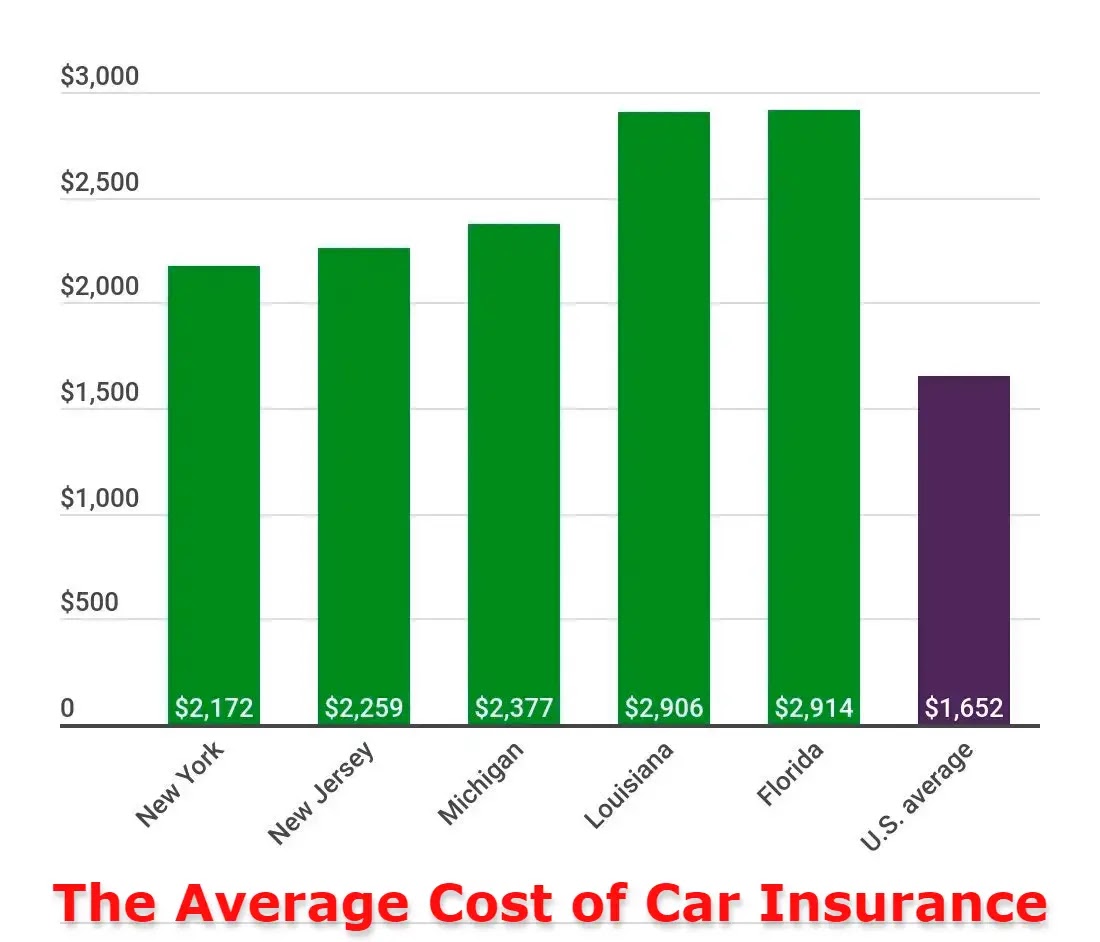

Michigan has the highest car insurance rates with an average cost of $3,096 per year, $700 more than second-ranked Louisiana.

USAA is the carrier with the cheapest car insurance rates at $885 per year.

Driving under the influence causes a 75% increase in the average rate.

Drivers with bad credit pay 71% more than those with good credit, except in some states that don’t allow carriers to use credit scores when calculating rates.

different types of car insurance

Before we get into the average cost of car insurance, we need to look at the types of auto insurance available.

There are four basic types of car insurance coverage:

Property Damage Liability Coverage: Covers damage caused to another person’s property when the policyholder is at fault for an accident.

Bodily Injury Liability Coverage: Covers medical expenses incurred by another person when the policyholder is at fault for an accident.

Collision Coverage: Covers damages caused to the policyholder’s vehicle when they are at fault for the accident.

Comprehensive coverage: Covers damages caused to the policyholder’s vehicle that were not caused by an accident, such as theft and weather.

All but two states (New Hampshire and Virginia) require drivers to have liability insurance. In the two states that do not require it, drivers must be able to pay for property damage and bodily injury resulting from a car accident. For most drivers, liability insurance is still the most sensible option, even in states that don’t require it.

The minimum amount of legally required liability insurance varies by state and is often referred to as a minimum coverage policy. For example, the minimum coverage in a state may be at least $10,000 in property damage liability and $25,000 in bodily injury liability.

If a policy has all the four types of coverage mentioned above, then it is a full coverage policy. These policies can vary greatly in features and pricing depending on what the driver wants.

Average cost of car insurance: $1,569 per year

The average car insurance rate for full coverage is $1,569 per year, based on data from Coverage.com, Insure.com, The Zebra State of Auto Insurance 2019, and US News.

Breaking this down, the average car insurance cost per month is about $131. If you’re looking for a ballpark estimate of car insurance costs, plan on that.

Coverage-wise, minimum coverage is pretty cheap, with an average annual cost of $545

Car insurance prices tend to increase over time. Zebra found that the average auto insurance premium has increased 29.6% since 2011. However, this can vary greatly from year to year. In 2013, the average premium amount decreased by 6.3%. Other years have seen growth of up to 6.9%.

Average Cost of Car Insurance by Age Range Average Annual Rate (Full Coverage) Teens $5,023 20s $1,989 30s $1,532 40s $1,474 50s $1,365 60s $1,384 70s $1,611 80s $1,880

Data source: Zebra (2020).

Insurance rates can be very expensive for younger drivers, as they are more likely to be involved in accidents. This is mainly due to their lack of experience on the road and because they are more prone to reckless behavior.

Drivers who maintain a clean driving record will see their car insurance costs drop sharply. The average premium for a 16-year-old driver is $6,600 per year, but by the time drivers reach their 20s, it’s less than $2,500.

Average Cost of Car Insurance by Gender

Conventional wisdom is that male drivers pay more for car insurance than female drivers. It’s not completely true.

Among younger drivers, Zebra found that the average auto insurance cost is higher for men. Teenage male drivers pay an average of 14% more than female drivers. And male drivers between the ages of 20 and 24 pay 8% more than female drivers of the same age.

At age 25 and above, there is no longer a noticeable difference in auto insurance policy rates. How much each gender pays when comparing rates for experienced drivers:

Gender Average Annual Rate (Full Coverage) Female $1,480 Male $1,470

Zebra (2020).

Seven states have banned carriers from using gender to determine car insurance rates. More will likely join them, especially as many states now allow residents to choose a non-binary gender designation.

If you think you may be overpaying because of your gender, be sure to check out a variety of car insurance quotes to find the best car insurance quote for you.

Average Cost of Car Insurance by Car Type Vehicle Type Average Annual Rate (Full Coverage) Hybrid $2,343 Sedan $2,242 SUV $1,868 Truck $1,741 Van $1,602

Data sources: Insure.com and The Zebra (2020).

Vans cost less to insure than any other type of vehicle and are $640 cheaper per year than sedans.

Hybrids can save drivers money at the pump, but they are more expensive to insure. This is because the cost of their repair is high.

If you’re wondering how much Tesla insurance costs, Insure.com found that the average rate is $3,110. The Tesla Model S was also the 10th most expensive vehicle to insure on Zebra’s list, at an average rate of $3,476.

Average Cost of Car Insurance by State Average Annual Rate (Full Coverage) Average Annual Rate (Minimum Coverage) Alabama $1,450 $554 Alaska $1,275 $478 Arizona $1,470 $614 Arkansas $1,698 $608 California $1,868 $648 Colorado $1,757 $673 Connecticut $1,696 $816 District of Delaware $1,803,922 Florida $2,309 $1,102 Georgia $1,609 $679 Hawaii $1,045 $411 Idaho $1,164 $394 Illinois $1,303 $464 Indiana $1,165 $438 Iowa $1,106 $304 Kansas $1,622 $483 $1,736 $614 Montana $1,534 $455 Nebraska $1,370 $386 Nevada $426 New Jersey $16, New York $4,438, $304, Kansas $1,622 $483 $1,736 $614 Montana $1,534 $455 Nebraska $1,370 $386 Nevada $4,26 New Jersey $12, New York $19,26, $12,97 North Carolina $955 $405 North Dakota $1,379 $417 Oklahoma $1,4103,75 $417 Oklahoma $1,4103,75 $14 $1,002 South Carolina $1,414 $633 South Dakota $1,708 $385 Tennessee $1,570 $473 Texas $1,415 $576 Utah $1,67306 Washington $641 Vermont $1,380 West $1,002 Virginia $1,536 $586 Wisconsin $1,181 $385 Wyoming $1,439 $339

Data source: Zebra (2020).

Where drivers live has a huge impact on their car insurance rates – just ask anyone who has moved and seen their premiums go up.

Michigan is by far the most expensive state for car insurance, with rates nearly double the national average. Minimum coverage in Michigan also exceeds full coverage in all but 10 other states.

Maine has the best car insurance rates for full coverage policies, averaging $935. For minimum coverage, Iowa is the clear winner with an average of just $304.

Insurance Company Average Cost of Car Insurance by Insurance Company Affordable Rates for Moderate Level of Coverage USAA $885 Geico $1,168 State Farm $1,234 Traveler $1,267 Progressive $1,373 American Family $1,391 Farmer $1,682 Nationwide $1,864 Allstate $1,880

Data source: US News (2020).

This shows why it is so important for drivers to compare auto insurance rates from different carriers. Choosing the right insurance company can save hundreds of dollars.

USAA has traditionally received high marks for the quality and pricing of its car insurance policies, and has some of the lowest average rates. This carrier is only available to members of the military (active or ex-servicemen) and eligible family members.

How driving record affects car insurance rates Negative items on driving record Average premium increase Speeding ticket 22% Accident 43% Driving under the influence (DUI) 75% Bad credit 71%

Data source: US News.

For consumers who do not have a clean driving record, auto insurance is much more expensive. A ticket, accident or DUI can result in a large rate increase.

Insurance carriers also use credit scores to determine rates, except for a handful of states that have banned it. Because drivers with bad credit are more likely to file insurance claims, they are charged more.

There is more to the shocking part. A bad credit score can cost a driver almost as much as a DUI.

We also have data on how much rates move up on average with the most popular car insurance providers.

Carrier cheap rates for medium level coverage Speeding Ticket Accident DUI Bad Credit USAA $885 $1,041 (+17.6%) $1,229 (+38.9%) $1,683 (+90.2%) $1,653 (+86.8%) Geico $1,168 $1,510 (+29.3%) $1,802 (+54.3%) $2,958 (+153.3%) $1,855 (+58.9%) State Farm $1,234 $1,375 (+11.4%) $1,487 (+20.5%) $1,681 (+36.2%) $2,745 (+122.4%) Passengers $1,267 $1,721 (+35.8) %) $1,842 (+45.4%) $2,430 (+91.8%) $2,095 (+65.4%) Progressive $1,373 $1,803 (+31.3%) $2,324 (+69.3%) $1,793 (+30.6%) $2,308 (+68.1%) US households $1,391 $1,497 (+7.6%) $1,684 (+21.1%) $1,726 (+24.1%) $2,277 (+63.7%) Farmers $1,682 $2,099 (+24.8%) $2,446 (+45.4%) $2,640 (+57.0%) $2,669 (+58.7%) nationwide $1,864 $2,263 (+21.4%) $2,766 (+48.4%) $4,011 (+115.2%) $2,549 (+36.7%) Allstate $1,880 $2,212 (+17.7%) $2,673 (+42.2%) $3,252 (+73.0%) $3,025 (+60.9%) ) )

Data source: US News.

Different carriers weigh negative items in different ways. State Farm is much more generous with rate increases after a speeding ticket, accident, or DUI. But it’s also very strict for drivers with bad credit.

Geico and Nationwide, on the other hand, don’t charge drivers with bad credit as much, but their rates skyrocket if the driver has a DUI.

How many uninsured motorists are on the road?

While the number of uninsured motorists has decreased over the past decade, there is still a lot out there.

A study by the Insurance Research Council found that 13% of motorists were uninsured in 2015. Some states were much higher than the average, with about 27% of Florida drivers having no auto insurance.

Uninsured or underinsured motorist coverage provides additional coverage if drivers are in an accident caused by an uninsured motorist or someone who does not have adequate insurance coverage.

A regular expense for each driver

While many factors are not within drivers’ control, there are many ways for them to obtain lower auto insurance costs.

They can choose insurance companies that offer lower prices and adjust coverage depending on whether they want more protection or a cheaper plan, for example. They can also work on improving credit to qualify for the best possible rates. Every driver should get multiple auto insurance quotes.

And, of course, drivers control how they drive, which is often the most important factor in the cost of their car insurance policy. People who follow the rules of the road and avoid accidents benefit in the long run by getting cheaper insurance.

Final Words

So friends, how did you like our post! Don’t forget to share it with your friends below the sharing button post. Apart from this, if there is any problem in the middle then do not hesitate to ask in the comment box. We will be happy to assist you. We will keep writing more posts related to this. So don’t forget to bookmark (Ctrl+D) our blog “Study toper” on your mobile or computer and subscribe to us now to get all posts in your email.

If you liked this post then don’t forget to share it with your friends. You can help us reach more people by sharing it on social networking sites like WhatsApp, Facebook, or Twitter. Thanks!